How to get final cut pro 7 for free windows. Accountants are well-compensated compared to other professions with similar education requirements, though the salary that you can earn as an accountant is dependent on several factors, including your geographic location and level of education and experience. The Bureau of Labor Statistics (BLS) notes that candidates with a master's in accounting may have an advantage in the job market.1 Certified public accountant (CPA) or other certifications like chartered financial analyst (CFA) or certified internal auditor (CIA) can also increase a candidate's base salary and provide opportunities for promotion.1 Additional factors that may determine your compensation level include your negotiating skills, the size of the company, and the industry you work in (e.g. insurance, tax preparation, healthcare, and so on). On this page, you will find further information about the factors that impact accountant salaries as well as a table outlining the best states for accountants.

- How Much Do Accountants Make In Iowa 2019

- How Much Do Accountants Make In Iowa Taxes

- How Much Do Accountants Make In Iowa

How Much Does an Accountant Make?

The BLS reports that the median annual wage for accountants and auditors nationally was $71,550 as of May 2019.1 The top-earning 10% of accountants and auditors earned more than $124,450, while the lowest-earning 10% earned less than $44,480.1 The top-paying industries for accountants and auditors were accounting, tax preparation, bookkeeping, and payroll services ($83,460 per year); management, scientific, and technical consulting services ($81,730 per year); and real estate ($77,830 per year).1

Robert Half's 2017 Accounting & Finance Salary Guide. According to Robert Half's 2017 Salary Guide for Accounting and Finance, professionals with a graduate degree or certifications (like a CPA license) make 5 to 15% more. Check out salary ranges for more than 400 positions in corporate and public accounting, finance, banking, and financial. Significantly, Washington has a very active CPA job market as there are several companies currently hiring for this type of role. With only a handful of states paying above the national average, the opportunities for economic advancement by moving to a new locationas a CPA is a decision to make with some caution. According to Robert Half's 2017 Salary Guide for Accounting and Finance, professionals with a graduate degree or certifications (like a CPA license) make 5 to 15% more. Check out salary ranges for more than 400 positions in corporate and public accounting, finance, banking, and financial services.

Specialty roles within these larger fields also impact salary. According to the Robert Half 2021 Salary Guide, the median salary for senior internal auditors was $90,500 per year, compared to senior financial reporting specialists and SEC financial reporting analysts ($85,000 per year), general accountants ($81,000 per year), and cost accountants ($81,750 per year).2 As in other industries, an individual's experience makes a difference, too – according to Robert Half's salary data, those with only one to three years of experience in these areas typically make $10,000 to $15,000 less per year than their more senior counterparts.2 The table below provides an easy-to-digest overview of the differences in requirements, salary, and outlook for different types of accountants.

| Role | Typical Highest Education Level Recommended3-8 | Number Employed in the US3-10 | Average Annual Openings3-10 | 10-Year Job Growth3-10 | Average Salary3-10 |

|---|---|---|---|---|---|

| Accountants and Auditors | Bachelor's degree (48%*) | 1,436,100 | 90,700 | 6.4% | $71,550 |

| Financial (Quantitative) Analysts | Master's degree (65%) | 487,800 | 30,900 | 6.2% | $81,590 |

| Financial Examiners | Bachelor's degree (87%) | 66,900 | 5,200 | 7.1% | $81,090 |

| Financial Managers | Bachelor's degree (50%*) | 697,900 | 64,900 | 16% | $129,890 |

*As of 2018.

Accountant Salary and CPA Outlook by State

The following sortable table provides data on accounting salaries by state as well as the rate of job growth and the cost of living as it relates to the ratio of the average salary/median home list price. The best states for accountants are weighted by the percentage the average salary buys of the median list price for homes in a given state and the projected job growth. This data can provide insight on whether accounting job growth and salary potential justify the costs of attending a master's in accounting program.

| Rank | StateUS Average | Accountants and Auditors Mean Salary (2019)9$79,520 | Zillow Home Value Index (2020)11$263,351 | % of Zillow Home Value Average Salary Buys30% | Accountants and Auditors Employed (2018)101,424,000 | Projected Accountants and Auditors Employed (2028)101,514,700 | 10-Year Growth Rate (2018- 2028)106% | Best States for Accountants and Auditors (Avg=1)1.00 |

|---|---|---|---|---|---|---|---|---|

| 1 | West Virginia | $67,340 | $110,544 | 61% | 4,100 | 4,400 | 7% | 1.87 |

| 2 | Arkansas | $66,450 | $140,986 | 47% | 8,790 | 9,900 | 13% | 1.63 |

| 3 | Oklahoma | $74,130 | $139,409 | 53% | 15,860 | 16,810 | 6% | 1.62 |

| 4 | Georgia | $79,690 | $218,609 | 36% | 39,410 | 47,670 | 21% | 1.57 |

| 5 | Texas | $79,360 | $220,034 | 36% | 128,250 | 152,310 | 19% | 1.50 |

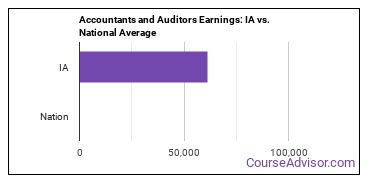

| 6 | Iowa | $69,480 | $157,308 | 44% | 12,010 | 13,190 | 10% | 1.48 |

| 7 | Alabama | $72,120 | $156,265 | 46% | 17,930 | 19,200 | 7% | 1.46 |

| 8 | Kentucky | $67,660 | $156,926 | 43% | 12,280 | 13,480 | 10% | 1.45 |

| 9 | Mississippi | $65,420 | $131,973 | 50% | 7,470 | 7,660 | 3% | 1.43 |

| 10 | Tennessee | $71,460 | $203,134 | 35% | 22,380 | 26,050 | 16% | 1.41 |

| 11 | Indiana | $71,690 | $169,156 | 42% | 22,060 | 23,670 | 7% | 1.36 |

| 12 | Kansas | $68,780 | $164,336 | 42% | 13,820 | 14,850 | 7% | 1.35 |

| 13 | Utah | $68,560 | $386,723 | 18% | 11,470 | 15,040 | 31% | 1.34 |

| 14 | Ohio | $73,380 | $164,968 | 44% | 50,100 | 51,340 | 2% | 1.28 |

| 15 | South Carolina | $67,740 | $203,328 | 33% | 17,350 | 19,420 | 12% | 1.24 |

| 16 | Nebraska | $70,420 | $189,139 | 37% | 9,910 | 10,690 | 8% | 1.23 |

| 17 | North Carolina | $78,500 | $220,710 | 36% | 38,020 | 41,280 | 9% | 1.21 |

| 18 | Missouri | $69,160 | $176,609 | 39% | 28,530 | 29,930 | 5% | 1.21 |

| 19 | Pennsylvania | $76,720 | $211,287 | 36% | 57,540 | 61,020 | 6% | 1.16 |

| 20 | New York | $98,650 | $343,164 | 29% | 121,110 | 136,510 | 13% | 1.13 |

| 21 | Florida | $72,630 | $264,149 | 27% | 79,560 | 90,610 | 14% | 1.13 |

| 22 | Michigan | $75,170 | $187,747 | 40% | 37,190 | 37,460 | 1% | 1.11 |

| 23 | Illinois | $77,640 | $217,105 | 36% | 58,210 | 61,040 | 5% | 1.11 |

| 24 | Louisiana | $66,230 | $177,548 | 37% | 10,830 | 11,170 | 3% | 1.11 |

| 25 | Wisconsin | $71,260 | $207,018 | 34% | 25,500 | 26,990 | 6% | 1.10 |

| 26 | South Dakota | $67,470 | $222,435 | 30% | 5,000 | 5,490 | 10% | 1.10 |

| 27 | Colorado | $82,930 | $431,100 | 19% | 40,780 | 48,950 | 20% | 1.07 |

| 28 | Arizona | $73,450 | $303,230 | 24% | 10,960 | 12,550 | 15% | 1.06 |

| 29 | Nevada | $68,030 | $327,714 | 21% | 2,860 | 3,350 | 17% | 1.04 |

| 30 | Connecticut | $83,680 | $281,924 | 30% | 18,270 | 19,430 | 6% | 0.99 |

| 31 | Wyoming | $66,360 | $258,280 | 26% | 1,990 | 2,190 | 10% | 0.98 |

| 32 | Virginia | $85,720 | $302,369 | 28% | 45,510 | 48,820 | 7% | 0.97 |

| 33 | New Mexico | $64,770 | $224,374 | 29% | 6,600 | 7,040 | 7% | 0.97 |

| 34 | North Dakota | $64,260 | $236,012 | 27% | 3,870 | 4,180 | 8% | 0.96 |

| 35 | Washington | $81,970 | $458,313 | 18% | 37,580 | 43,870 | 17% | 0.95 |

| 36 | Maryland | $81,920 | $335,260 | 24% | 28,530 | 31,240 | 9% | 0.93 |

| 37 | Delaware | $80,010 | $277,979 | 29% | 5,990 | 6,290 | 5% | 0.92 |

| 38 | Minnesota | $73,590 | $277,276 | 27% | 25,410 | 27,070 | 7% | 0.90 |

| 39 | Alaska | $79,300 | $296,646 | 27% | 1,930 | 2,050 | 6% | 0.90 |

| 40 | Montana | $66,170 | $313,261 | 21% | 3,490 | 3,890 | 11% | 0.89 |

| 41 | New Jersey | $91,960 | $367,103 | 25% | 41,790 | 44,600 | 7% | 0.87 |

| 42 | Idaho | $65,440 | $331,126 | 20% | 4,130 | 4,620 | 12% | 0.86 |

| 43 | Vermont | $74,640 | $273,024 | 27% | 3,280 | 3,410 | 4% | 0.86 |

| 44 | Oregon | $73,180 | $393,710 | 19% | 13,510 | 15,210 | 13% | 0.85 |

| 45 | Rhode Island | $83,340 | $331,458 | 25% | 5,090 | 5,390 | 6% | 0.85 |

| 46 | New Hampshire | $72,750 | $321,496 | 23% | 5,890 | 6,370 | 8% | 0.84 |

| 47 | Maine | $70,090 | $269,753 | 26% | 5,270 | 5,280 | 0% | 0.72 |

| 48 | Washington DC | $103,930 | $666,767 | 16% | 12,950 | 14,000 | 8% | 0.65 |

| 49 | Massachusetts | $83,800 | $464,279 | 18% | 39,030 | 40,490 | 4% | 0.60 |

| 50 | California | $83,910 | $609,757 | 14% | 168,800 | 181,800 | 8% | 0.59 |

| 51 | Hawaii | $66,020 | $667,005 | 10% | 5,340 | 5,590 | 5% | 0.40 |

Additional Resources

- Salary Guides from Robert Half: Provides data and analysis of starting salaries, hiring environment, and general financial services trends.

- Association of International Certified Professional Accountants: AICPA is a membership-driven organization that provides professional development and career and salary information specifically for CPAs.

- National Society of Accountants: The NSA provides career resources for working professional accountants in various sectors of industry.

References:

1. Bureau of Labor Statistics Occupational Outlook Handbook, Accountants and Auditors: https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm

2. Robert Half 2021 Salary Guide for Accounting and Finance Professionals: https://www.roberthalf.com/sites/default/files/documents/2018_salary_guide_US_accounting_and_finance.pdf

3. O*NET OnLine, Accountants and Auditors: https://www.onetonline.org/link/summary/13-2011.00

4. O*NET OnLine, Financial Quantitative Analysts: https://www.onetonline.org/link/summary/13-2099.01

5. Bureau of Labor Statistics Occupational Outlook Handbook, Financial Analysts: https://www.bls.gov/ooh/business-and-financial/financial-analysts.htm

6. O*NET OnLine, Financial Examiners: https://www.onetonline.org/link/summary/13-2061.00

7. O*NET OnLine, Financial Managers: https://www.onetonline.org/link/summary/11-3031.00

8. Bureau of Labor Statistics Occupational Outlook Handbook, Financial Managers: https://www.bls.gov/ooh/management/financial-managers.htm

9. Bureau of Labor Statistics, Occupational Outlook Handbook, Accountants and Auditors: https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm

10. Projections Central: https://projectionscentral.com/Projections/LongTerm

11. Zillow.com: https://www.zillow.com/home-values/ (data from November 2020)

Services & Fees

How our fees work: Unlike many firms we do not charge by the hour or by the form. We provided upfront pricing which means you will know and agree to our fee prior to us beginning any work or you making any commitment. Once we have all or at least all material information required to prepare the return or project we determine our fee based on your unique tax and accounting needs. Fees comes down to the time it will take us to prepare, review and finalize the return or project based on the complexity of the services needed. We ask for 50% of the fee prior to beginning any work and the balance when we provided you with a draft. We DO NOT offer refund anticipation loans.

Tax Happens Fees for Services

Pricing subject to change, adjusted to meet individual clients unique needs and discounted when multiple services utilized. We work with all clients to determine how we can work together to meet their tax and accounting needs at a price they can afford. Fees are determined and agreed upon once ALL information is received and prior to beginning any work. Tax preparation fees do not include audit support.

15% Military Discount

50% of Fee Is Due Prior to Work Beginning.

Balance is due when draft is provided. Final copy and e-filing will not be provided until balance is paid.

Hourly Services

Consultation $175 per hour

$175 for up to 1 hour of time with CPA

Federal or State Correspondence $175 per hour

This fee does not apply to current clients for tax years we were engaged for.

Tax Return Preparation & Filing

How to download minecraft on a new computer. Personal Federal Income Tax Preparation $300 – $650

1040 return and related statements, including cost of e-filing or mailing (does not include audit support)

Personal Federal AMENDED Income Tax Preparation $400 – $650

Amended 1040 return and related statements, including cost of mailing (does not include audit support)

Personal State Income Tax Preparation $200 – $400

Return and all related forms, including cost of e-filing or mailing (does not include audit support)

Business Federal Income Tax Preparation $650 – $1500

1120, 1120s, 1065 and all related forms, including cost of e-filing or mailing (does not include audit support)

Business State Income Tax Preparation $500 – $1000

Return and all related forms, including cost of e-filing or mailing (does not include audit support)

Tax Exempt Federal Return Preparation $600 – $1200

Form 990's and all related forms, including cost of e-filing or mailing (does not include audit support)

Sales Tax Return Preparation $100 – $150 per filing

Per state, per filing (does not include audit support)

Payroll Federal & State Annual Return Preparation $250

W2/W3 Filings for Up to 5 Employees ($10 Each employee over 5) (does not include audit support)

Payroll Quarterly Return Preparation $200 per quarter 1st, 2nd & 3rd quarter – $250 4th quarter

Quarterly 941 and Applicable State Filings – Fee is per filing for up to 5 employees ($10 each employee over 5) (does not include audit support)

Annual Federal 1099 Filing Preparation $250

Filings for Up to 5 Contractors – ($10 each additional contractor) (does not include audit support)

Bookkeeping Service

Monthly/Quarterly Bookkeeping Services

Small Businesses starting at $200 per month

Quarterly QuickBooks Review and Reconciliation

Small businesses starting at $575 per quarter – average per quarter $575 – $2,000

Annual QuickBooks Review and Reconciliation

Small businesses average $600 – $1,500

How Much Do Accountants Make In Iowa 2019

Quarterly Financial Statement Preparation

Small businesses average per quarter $575 – $1,000

Annual Financial Statement Preparation

Small business average $1,200 – $2,000

How Much Do Accountants Make In Iowa Taxes

New Business Set Up

Articles of Organization or Incorporation $200

Does not include State Fee (varies by state)

Tax Identification Number $75

S-Corporation Election $75

Preparation and Electronic Filing of Form 1023-EZ Federal application for tax exempt status $400

Does Not Included Federal Fee ($275* this can change)

How Much Do Accountants Make In Iowa

Preparation of form 1023 Federal Application for Tax Exempt Status

Small Tax-Exempt entities average $600 – $1,500 – Does Not Include Federal Fee (About $400 to $850)